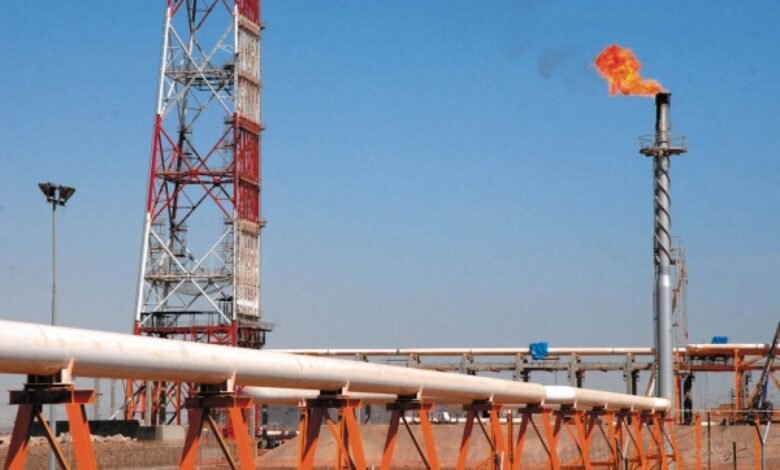

Natural gas development in Morocco: Tendrara and future projects up to 2030

Economy of the East

The imminent launch of the Tandrara field marks a strategic turning point for Morocco in the field of natural gas development, especially since the country did not have sufficient fossil resources. This important step opens the door to new gas discoveries and enhances the attractiveness of the Kingdom for international oil majors to invest in the sector. However, this discovery alone will not be enough to meet the growing demand for gas by 2030, raising questions about other planned projects.

Morocco has chosen natural gas as a transitional fossil energy due to its low greenhouse gas emissions, and it can be replaced in the future by green hydrogen when the latter reaches commercial maturity. According to the National Natural Gas Roadmap 2025-2030, gas demand is expected to rise from the current 1.2 billion cubic meters to 8 billion cubic meters by 2027, which coincides with the commissioning of the West Mediterranean port of Nador and the conversion of several power plants to gas with increased capacity.

Demand is expected to jump to 12 billion cubic meters by 2030, when the Atlantic LNG terminal in Mohammedia or Yellow Shelf, which will be the second import point after Nador, is expected to open. This decadal doubling of demand in five years makes it imperative to secure sources of supply, especially in light of the increasing complexity of the global gas market.

It is clear that the production of the Tendrara field, which will reach 400 million cubic meters per year after the completion of the second phase, will not even cover current demand. Morocco is therefore betting on the Africa-Atlantic gas pipeline to meet the expected increase in demand by 2030. With the recent creation of a dedicated project company, the Nigeria-Morocco gas pipeline project is moving towards final structuring and securing the necessary financing.

Final investment decisions for Phase 1A and 1B are expected at the end of 2025 or beginning of 2026, with the first gas to be pumped between 2029 and 2030. This phase includes the construction of the southern section connecting Nigeria to Ghana and Ivory Coast, and the northern section connecting Senegal and Mauritania to Morocco. Thanks to the Morocco-Europe gas pipeline, the northern section will provide a connection to the European grid by 2030, pending a gradual connection to the central and southern sections.

During the Power-to-X Global Summit on October 1-2, 2025, Oumy Khaïry Diao Diop, Permanent Secretary for Energy of the Republic of Senegal, emphasized that her country is committed to the development of gas infrastructure, including the Africa Atlantic Gas Pipeline project that will allow the gas produced with Mauritania from the offshore GTA field to be marketed profitably.

Gas reserves in the Tendrara field could be even higher, as several potential geological formations are yet to be fully explored. Mana Energy, the operator of the project, is betting on two potential locations that could release potential resources of between 12 and 25 billion cubic meters depending on medium and low success estimates.

For this purpose, Mana Energy plans to drill two exploration wells: SBK-1 in the Tendrara license, and M5 in the Anoual license. Negotiations for a new drilling rig are currently underway, pending authorizations from the Ministry of Energy Transition. The M5 well in the Anoual license is targeting a similar trap formation in the same reservoir called TAGI, a sandy clay reservoir equivalent to the one that produced huge gas fields in Algeria. Although the chances of success are relatively modest, a gas discovery could release a potential of at least 9 billion cubic meters.

The SBK-1 well, located in the Tendrara license, has a better chance of success. It had produced gas on the surface during tests in 2000, but in a location that was deemed less than ideal. After a reassessment, the new drilling location is targeting a more promising gas reservoir. If successful, the recoverable gas from this well is estimated to be at least 3.9 billion cubic meters.

UK-based Chariot is implementing a new strategy aimed at developing a rescaled Anchois field to accelerate its exploitation. It has also initiated a farmout of the offshore Lixus and Rissana licenses, as well as the onshore Loukous license, in search of a new partner to revive and reinvigorate gas exploration in Morocco.

In the Lixus license, close to the coast, the Anguille gas prospect represents a potential of 14 billion cubic meters. It is awaiting a drilling operation to prove the presence of gas and its exploitability. If confirmed, this discovery could be an additional source of supply allowing for a better valuation of the Anchois field.

In the Rissana license, Chariot is considering two potential locations. The first is located at an alluvial cone of the same age as the Anchois field, and the second off Kenitra targets older reservoirs. Both offer a potential of several billion cubic meters of hydrocarbons, but only drilling will confirm their existence and exploitability.

The conversion of the ONHM into a joint stock company allows the organization, which was previously limited to a promotional role, to perform a more active function by investing in exploration projects and sharing risks. This development is expected to encourage more operators to invest in Morocco.

In conclusion, it is clear that the Kingdom of Morocco is on track to tenfold its natural gas consumption. Although the exploitation of the Tendrara and Anchois fields will not cover the expected increase in demand starting in 2026, the first phase of the Africa Atlantic gas pipeline connecting Senegal to Morocco will meet this demand by 2030, with the possibility of exporting it to Europe. Pending the operation of the West Mediterranean port of Nador and the Africa Atlantic gas pipeline, the ministry must secure supply contracts to keep pace with the expected increase in the coming years, while efforts continue to unlock additional resources that could amount to tens of billions of cubic meters.

This week's edition of your magazine

This week's edition of your magazine